Benefits Of Free Trade Zones In Nigeria

Tax holidays licence waivers and various other concessions and advantages apply to investors in the Lekki Free Trade Zone LFTZ. 100 foreign ownership of enterprises in the zone allowed.

Free Trade Zones And Viability Theory Ships Ports

There are many benefits available for an enterprise when it is set up in a Free Trade Zone in Nigeria.

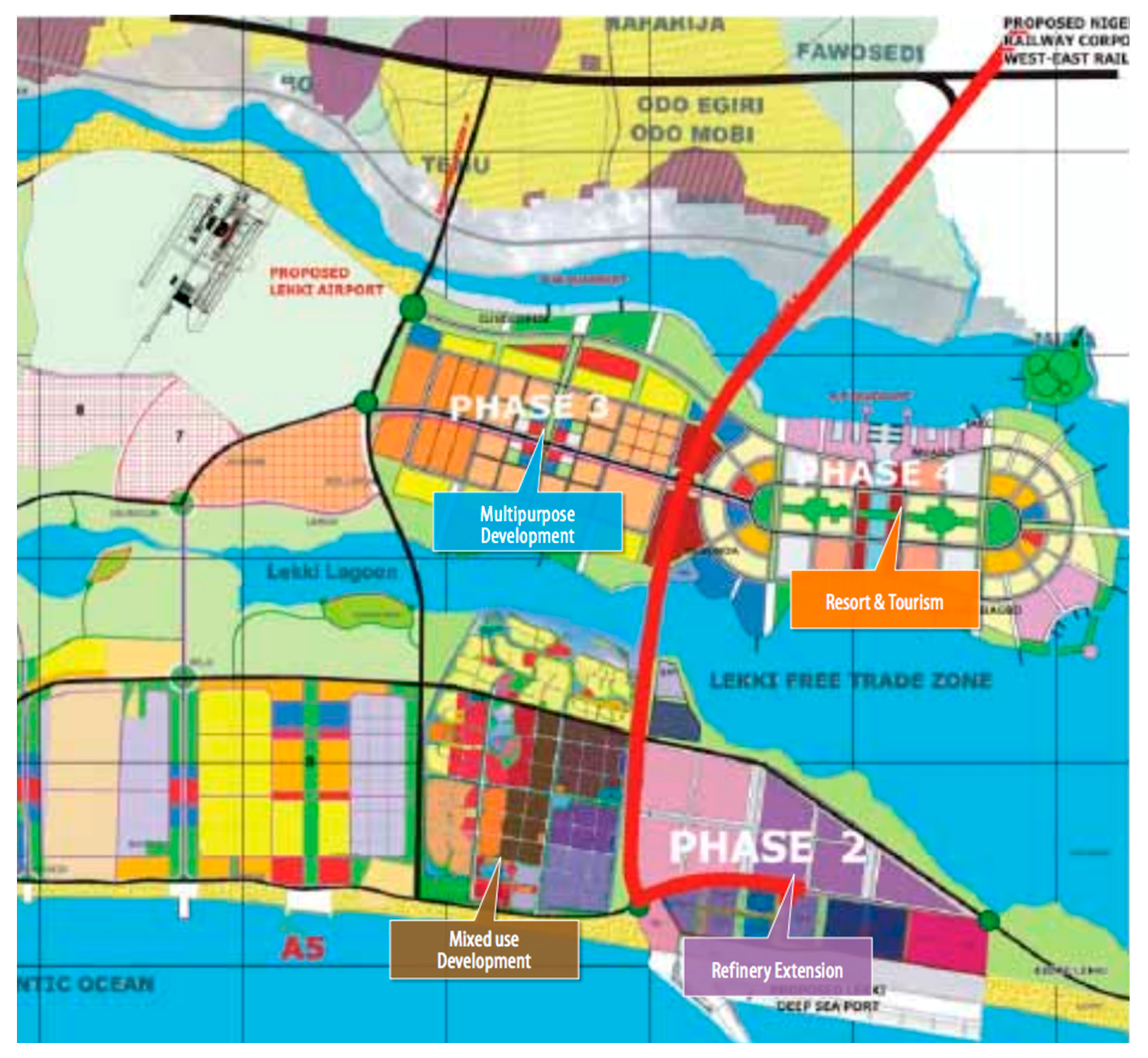

Benefits of free trade zones in nigeria. Attract foreign direct investment generate employment enhance trade and industrialization promote exports enhance foreign exchange earnings encourage transfer of technical know-how to Nigerians and contribute to the economic growth and development of Nigeria facilitate and expand international trade attract offshore activity and. When the idea of Free Trade Zones was conceptualised by the Federal Government when it created the Nigerian Exports Processing Zones Authority in 1992 the objective was to. In 2004 the Lagos State government initiated the Lekki Free Trade Zone project with a vision to fully utilize the investment business and tourism potential of Lagos.

Benefits of Free Trade Zones in Nigeria A Free Trade Zone can accumulate direct foreign investments. Other Benefits of Investing in Nigeria Free Zones 32The following benefits also accrue to investors in Nigerias free trade zones 32 httpwwwnepzagovngincentivesasp 1. The policy underpinnings for Nigerian FTZs include.

Some of the benefits of doing in any of the free trade zones in Nigeria include No import or export license required. Access to the Nigerian consumer market which is by far the largest consumer market in. LADOL Free Zone which provides onshore and offshore logistics support for hydrocarbons production and exploration.

FREE TRADE ZONES AND THE NIGERIA TAX REGIME FREE TRADE ZONES A free trade zone can be defined as a duty free geographical area where goods are brought into manufactured reconfigured for transshipment andor re-export operations. The ultimate aim was for the free trade zone scheme to attract foreign direct investment generate employment enhance trade and industrialization promote exports enhance foreign exchange. The Free zone will provide traders with a global getaway for the regional and International markets.

Impact of free trade zone on Nigerias property sector. Free Trade Zone Incentives in Nigeria The Federal Government of Nigeria has passed an aggressive free zones law NIGERIA EXPORT PROCESSING ZONES ACT which has created a business friendly environment benefiting from the following incentivesComplete tax holiday for all Federal State and Local Government taxes rates custom duties and leviesOne-stop approval for all permits operating. Such matters will include power for each Free Zone Enterprise to borrow grant security guarantee any obligation of any person or indemnify any person to enter into all types of banking and financial transactions to issue make endorse or draw any negotiable instruments such as cheques bills of exchange promissory notes or bills of lading in relation to its business and power for each Free.

But it is being revitalised as part of the governments drive to diversify exports away from oil with Adesugba brought in from the private sector this year to give the scheme renewed momentum. At the same time foreign traders can expect to pay new duties according to the Nigerian tax law. NIGERIA EXPORT PROCESING ZONES AUTHORITY 1 P a g e CHECKLIST FOR ESTABLISHING INDUSTRIAL PARKCITY WITH FREE TRADE ZONE STATUS IN NIGERIA o Application letter indicating interest to establish a Free Zone and its location in the country o Payment of USD 1000- Processing Fee Submission of the following documents.

Although the free zone scheme is not new to Nigeria it dates back to 1992 it has failed to yield the intended result of driving industrialisation and creating jobs. And Lekki Free Trade Zone which is home to over 95 enterprises. Any legislative provision related to taxes levies duties and some foreign exchange regulations which are actually applicable in the country shall not apply to the companies set up in a Free Trade Zone.

Private general EPZs that are already operating in the country include Snake Island Integrated FZ SIIFZ which is the first registered EPZ in Nigeria. A Free Zone is a specially designated region clearly demarcated and administratively considered to be outside the Customs Territory of the host country having special regulatory and fiscal incentive regimes to enhance its competitiveness. Unrestricted remittance of profit and dividends earned by investors in the zone.

Some of these advantages include the followings. They are majorly setup around seaports international airports and other areas with many geographical advantages. Its one of the crucial factors for the survival of the country.

An Overview Of Six Economic Zones In Nigeria Challenges And Opportunities

Africa S Free Trade Zone Is On Course Africa Dw 08 02 2019

Lekki Free Zone Set To Transform Nigeria S Fortunes World Finance

Free Trade Zones Nigeria Tax Regime Templars Law Firm

Understanding Nigeria S Free Trade Zone Scheme The Guardian Nigeria News Nigeria And World News Guardian Arts The Guardian Nigeria News Nigeria And World News

Nigeria S Free Trade Zones Locating Nigeria S Tax Free Goldmines Taxaide

Free Trade Zone In Nigeria Benefits Of Free Trade Zones In Nigeria Business Setup Worldwide

Doc Free Trade Zones And The Nigeria Tax Regime Free Trade Zones Olufemi Idogun Academia Edu

Free Trade Zones Nigeria Tax Regime Afolabi Elebiju Acti Ppt Download

Land Free Full Text Compensation For Expropriated Community Farmland In Nigeria An In Depth Analysis Of The Laws And Practices Related To Land Expropriation For The Lekki Free Trade Zone In Lagos

Posting Komentar untuk "Benefits Of Free Trade Zones In Nigeria"